As part of its fresh move against money laundering, the Federal Government has enforced a fine of N1m per day for any financial institution or non-financial business and profession that fails to report any suspicious transaction.

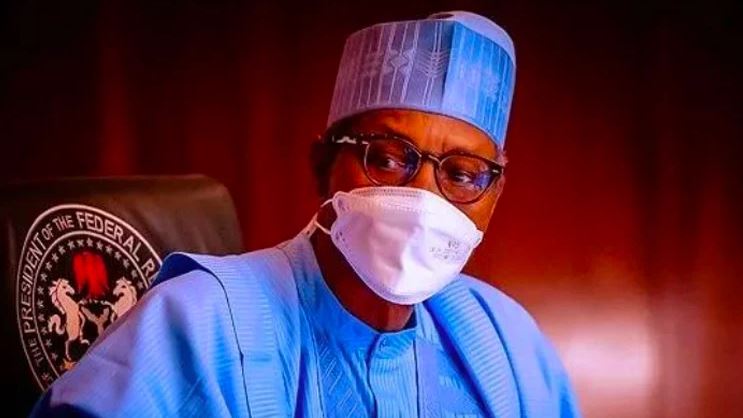

This is according to the Money Laundering (Prevention and Prohibition) Bill, 2022, which the President, Major General Muhammadu Buhari (retd.), recently assented to and passed into law.

In Section 7 of the Act, which was titled ‘Suspicious transaction reporting’, it was stated that a suspicious transaction could be any transaction that involves an unjustifiable or unreasonable frequency.

It also involves any transaction surrounded by conditions of unusual or unjustified complexity, appears to have no economic justification or lawful objective or is inconsistent with the known transaction pattern of the account or business relationship.

The Act added that a suspicious transaction could also be any transaction, which in the opinion of the financial institution or non-financial business and profession, involves the proceeds of criminal activity, unlawful act, money laundering or terrorist financing.

Section 7(10) of the Act read in part “A financial institution or designated non-financial business and profession which fails to comply with the provisions of subsections (1) and (2) of this section commits an offence and is liable on conviction to a fine of N1m for each day during which the offence continues.”

It added that the directors, officers and employees of financial institutions and designated non-financial businesses and professions who implement their duties under this Act in good faith are not liable to any civil or criminal liability or have any criminal or civil proceedings brought against them by their customers.

The Money Laundering (Prevention and Prohibition) Act, a copy of which was obtained by our correspondent, established a Special Control Unit Against Money Laundering under the Economic and Financial Crimes Commission, which is to monitor financial transactions within and outside Nigeria.

It is expected that the financial institution and designated non-financial business and profession involved in any suspicious transaction should report to the Special Control Unit immediately.

The Act mandated such a business or profession to prepare a written report on the transaction, take relevant action to prevent the laundering of the proceeds of a crime or an illegal act, and report the suspicious transaction to the Unit within 24 hours of the transaction.

It also mandated the unit to acknowledge receipt of any report and may demand additional information, with the acknowledgement of receipt sent to the financial institution or designated non-financial business and profession within the time allowed for the transaction to be undertaken and it may be accompanied by a notice deferring the transaction for a period not exceeding 72 hours.

However, it added that if the acknowledgment of receipt is not accompanied by a stop notice, or the stop notice has expired, the financial institution or designated non-financial business and profession may implement the transaction.

It also stated that where it is not possible to ascertain the origin of the funds within the period of stoppage of the transaction, the Federal High Court may, at the request of the Unit through the Commission or their authorised representatives order that the funds, accounts or securities referred to in the report be blocked.

The Act further clarified that a financial institution includes banks, body corporates, associations, or group of persons, whether corporate or incorporate that carries on the business of investment and securities, virtual asset service providers, a discount house, insurance institution, debt factorization and conversion firm, bureau de change, finance company, money brokerage firm and such other business as the central bank or other appropriate regulatory authorities may from time to time designate.

The designated non-financial business and profession include automotive dealers, businesses involved in the hospitality industry, casinos, clearing and settlement companies, consultants and consulting companies, and dealers.

The dealers include those in jewelries, mechanised farming equipment, precious metals and precious stones, real estate, high-value dealers, hotels, legal practitioners and notaries, licensed professional accountants, mortgage brokers, supermarkets, tax consultants, trust and company service providers, pools betting, or such other businesses and professions as may be designated by the Minister responsible for Trade and Investment.